Beyond Baroque in Venice, California

Several years ago, when I was employed and making good money, I decided to join Beyond Baroque, a literary and arts center headquartered in Venice, California. When I retired on a mostly fixed income, I was appalled to discover that my membership was constantly being renewed, even though my intention was to make it a one-time event.

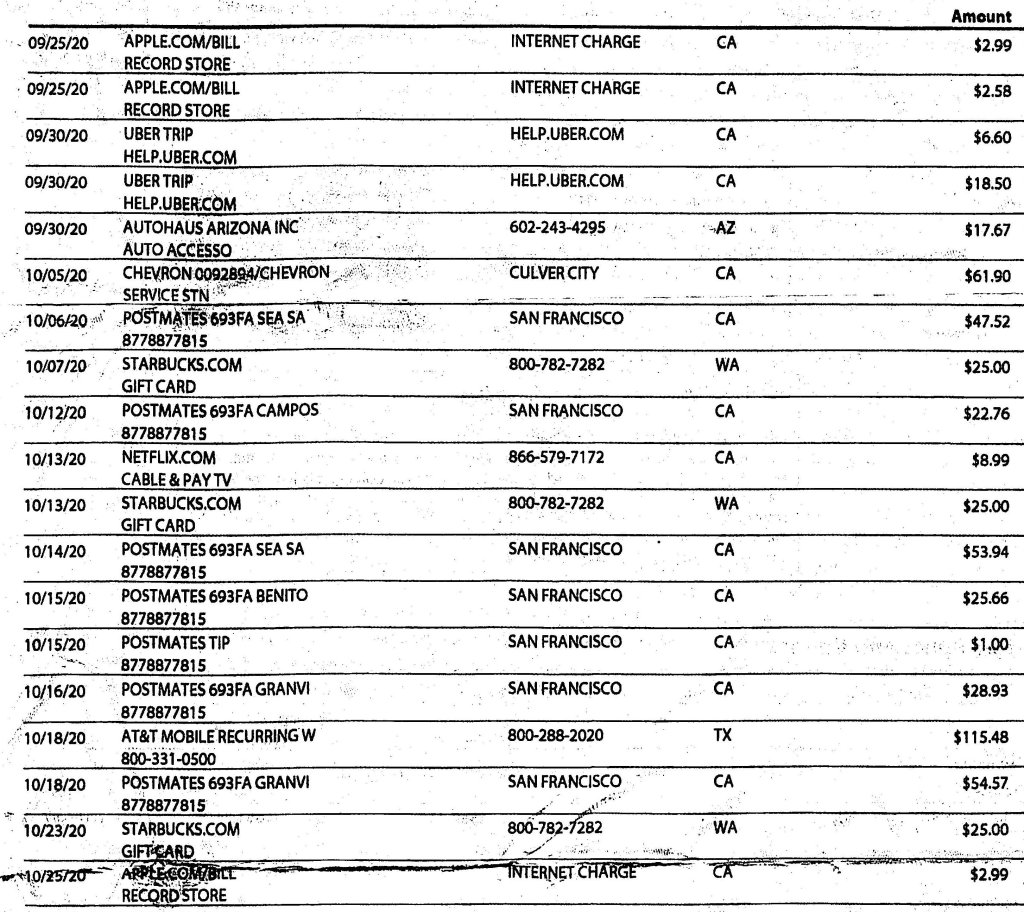

Since then, I have discovered that I have several “forever subscriptions,” some of which I don’t mind renewing, such as Flickr and WordPress. But what about the Entertainment Book, which no longer even produces a book but is now Internet-based?

Why is it not mandatory to request a renewal each year. Granted, many members would fall off the rolls; but I find it somewhat nasty to be charged annually, whether I want to be or not, for a service i do not used. I have even left messages for Beyond baroque, but they have never called me back. I suspect I will just have to show up in person and vent my displeasure face to face.

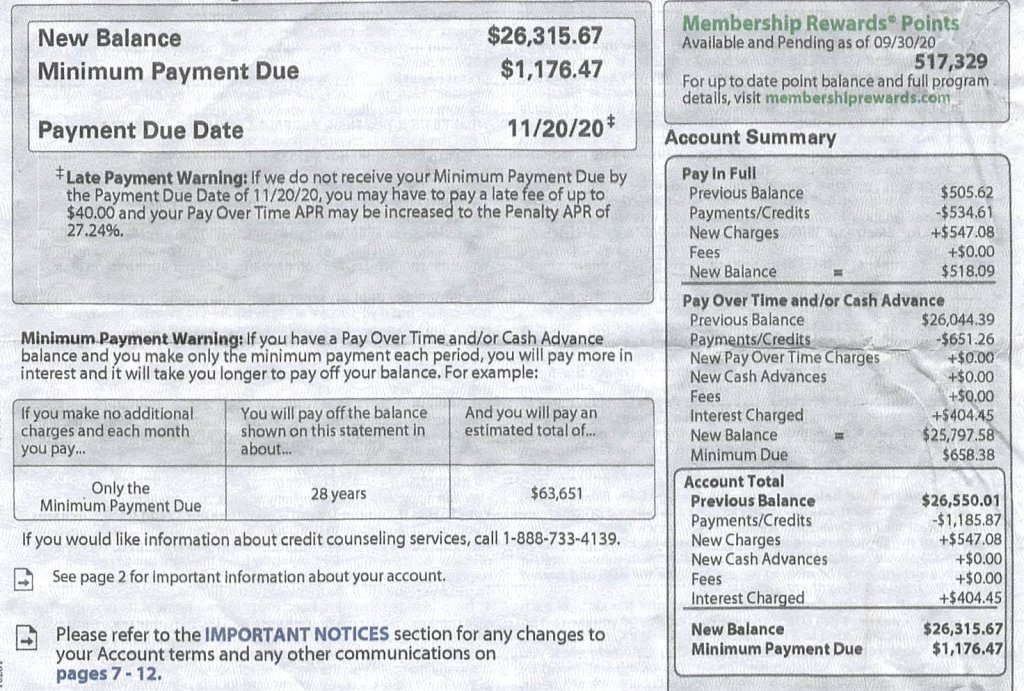

What I find particularly objectionable is that the credit card companies buy into this scam. I now have a new Discover card, but Discover still allows my old Discover card to be charged by Beyond Baroque.

You must be logged in to post a comment.