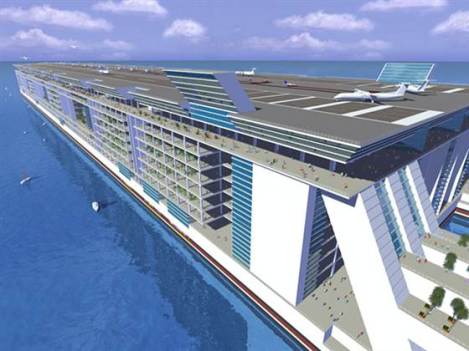

A Floating Tax Haven for the Rich in International Waters?

We all know that the rich just don’t like the notion of paying taxes. So what if they decided to build a giant floating city with built-in airfield in international waters, where—presumably—they would not be required to pay taxes? I think it’s a terrific idea. Before I give you some of my ideas, read the article on MSNBC that piqued my interest. Then, here’s what I have to add to the concept:

- Definitely put it right on the hurricane track between Africa and the Caribbean. Extra points for anchoring it in the Sargasso Sea and in the center of the famed (and scenic) Bermuda Triangle.

- For a flag of convenience, how about the Skull and Crossbones?

- Since this floating fat man’s paradise would belong to no nation in particular, it might be great for the navies of the world to use it for target practice.

- If someone were to send letters laced with anthrax and ricin to individuals aboard the ship, who would be responsible? The security guys?

- For service workers, of which there would be many, I think a ghettoized slum would be just the thing—no windows, poor ventilation, no extra charge for Legionnaires’ Disease. Then we could see how long before class warfare erupts.

I rather hope this fine idea comes to fruition. The possibilities are endless!

You must be logged in to post a comment.